Meta Description: AMD stock jumps 24% after OpenAI partnership announcement, prompting Jefferies to upgrade its rating and boost its price target from $170 to $300. Here’s what this means for AMD and the AI chip race.

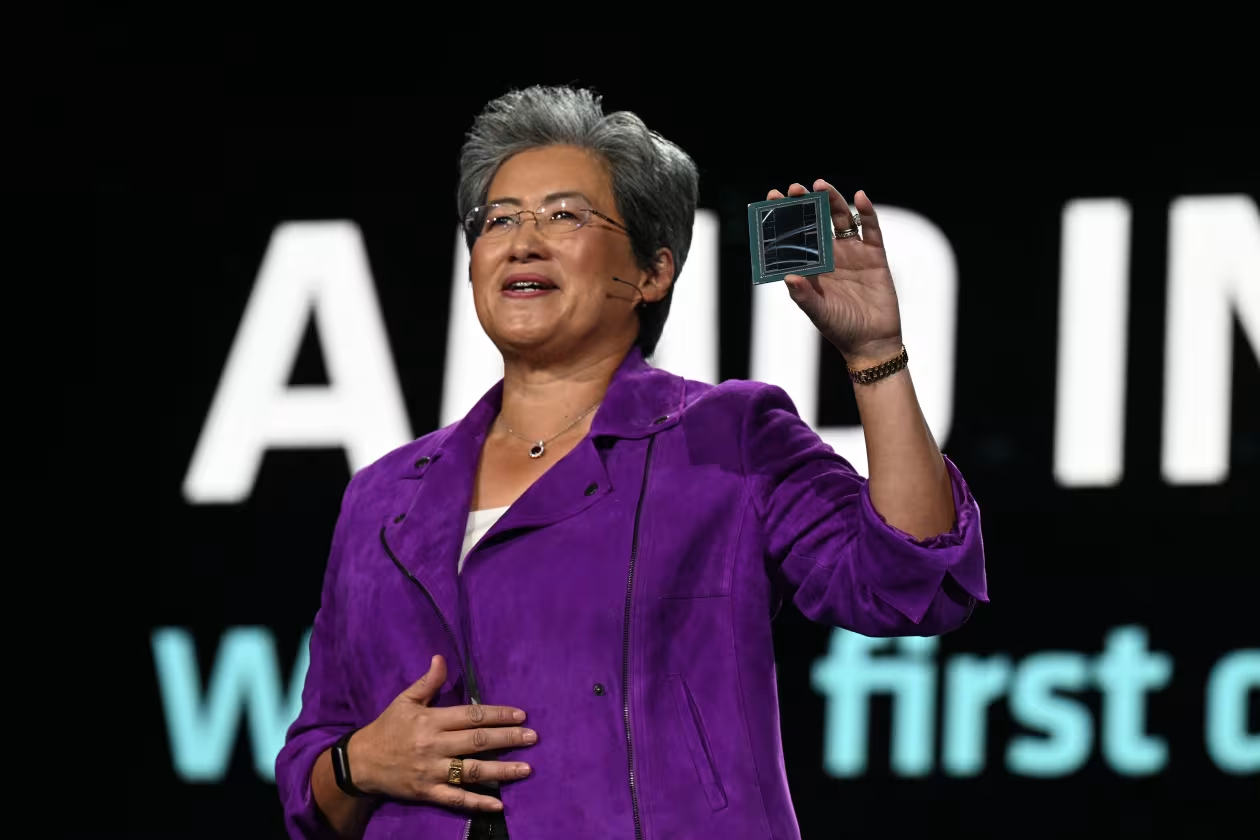

AMD’s Big Leap: From Caution to Confidence

Advanced Micro Devices (AMD) saw an impressive 24% surge in its stock price after news broke of its growing partnership with OpenAI, the creator of ChatGPT. The massive rally on Monday pushed analysts at Jefferies to upgrade AMD from “hold” to “buy,” a rare move that even the firm’s analysts acknowledged with surprise.

Blayne Curtis and his team at Jefferies admitted, “We rarely do this,” showing how unexpected AMD’s recent performance was. The analysts had already raised their forecasts the week before, but they underestimated how fast AMD’s AI chip business would grow.

The OpenAI Deal That Changed Everything

The upgrade followed reports that OpenAI plans to purchase up to 6 gigawatts (GW) of AMD chips. Jefferies estimated that this could lead to over $100 billion in revenue potential for AMD, marking one of the most significant opportunities in the company’s history.

Each gigawatt, according to AMD, could translate to “double-digit billions” in value — signaling an aggressive expansion in the AI hardware market.

OpenAI’s investment spree isn’t limited to AMD; it also includes Nvidia, Oracle, Hynix, and Samsung, as the company races to secure computing power for future AI growth.

Comparison: AMD vs. Other AI Chip Players

| Company | Focus Area | Recent AI Partnerships | Stock Outlook (as per analysts) |

|---|---|---|---|

| AMD | High-performance AI chips | OpenAI, expanding server market | Upgraded to $300 (Jefferies) |

| Nvidia | Dominant AI GPU maker | OpenAI, major cloud firms | Around $470 target (varies) |

| Intel | General computing & data centers | Limited AI exposure | Neutral to cautious |

This comparison shows how AMD is closing the gap with Nvidia and gaining investor trust in the AI hardware space.

Analyst Reactions and Market Outlook

Jefferies wasn’t the only one to take notice, but it was the most optimistic. Other banks like Goldman Sachs, Deutsche Bank, and Wedbush still maintain more conservative targets — some even below AMD’s current stock price of $203.71.

Jefferies, however, raised its price target to $300, the highest on Wall Street, citing “accelerating AI spending” as the key reason.

MarketWatch calculated AMD’s surge as a 6-standard-deviation move, a rare statistical event. Yet, surprisingly, it wasn’t AMD’s biggest single-day move of 2025 — that record belongs to its 23.8% rise on April 9.

The Future of AMD in the AI Era

The sudden upgrade underscores a new reality: AI spending is skyrocketing, and AMD is no longer just a secondary player. With partnerships like OpenAI’s and new data center capacity expansion, AMD is now firmly in the race for AI dominance.

While the road ahead may still hold challenges, one thing is clear — AMD’s leap into the AI revolution has reshaped investor confidence and possibly, the future of semiconductor competition.